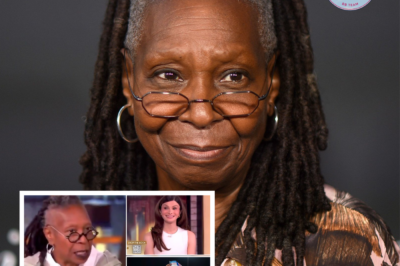

‘I work for a living’: Whoopi Goldberg says she relates to Americans ‘having a hard time’ — admits she’d leave ‘The View’ if she had ‘all the money in the world

‘I work for a living’: Whoopi Goldberg says she relates to Americans ‘having a hard time’ — admits she’d leave ‘The View’ if she had ‘all the money in the world’

We adhere to strict standards of editorial integrity to help you make decisions with confidence. Some or all links contained within this article are paid links.

Whoopi Goldberg has been co-hosting ABC’s “The View” since 2007, making her the longest serving member on the successful daytime show’s panel. However, the celebrated actor and comedian with EGOT status has admitted on the show that her tenure would have ended sooner if she had more money and that she isn’t immune from the financial pressure most Americans face.

“I appreciate that people are having a hard time. Me too. I work for a living,” she said. “If I had all the money in the world, I would not be here, OK? So, I’m a working person, you know?… My kid has to feed her family. My great-granddaughter has to be fed by her family. I know it’s hard out there.”

Goldberg’s admission of financial strain might come as a surprise given that CelebrityNetWorth estimates her net worth at $30 million. At age 69, Goldberg says she’s still working to pay the bills for herself and her family.

Her situation highlights how family and financial mismanagement can push Americans to work beyond retirement.

Financially squeezed

A survey by LiveCareer revealed a startling 61% of U.S. workers fear retirement more than death. The majority of respondents (82%) said they have considered delaying their retirement for financial reasons.

These statistics paint a grim picture of a workforce that’s feeling anxious and economically squeezed. Digging deeper into the stats reveals that these concerns are not restricted to the middle class or working class. According to PYMNTS Intelligence, 62% of all U.S. consumers now live paycheck to paycheck, including 36% of those whose annual incomes exceed $200,000.

Financial pressure has spread across the age and income spectrum. To mitigate this issue, here are three solid ways to better manage your money.

Better budgeting

A dynamic economy calls for a dynamic budget. For many families, it may no longer be enough to make simple assumptions about how much your monthly bills for essentials will be when prices are rising.

Instead, financial experts recommend turning your attention to income instead. Ramit Sethi, host of the Netflix series “How to Get Rich,” recommends the 50/20/30 rule, which puts after-tax income into three different baskets: 50% for necessary expenses, 20% for debt repayment and savings and 30% for everything else, including leisure.

“The goal is simple: decrease your debt, increase your savings and investments, and allow yourself some guilt-free spending,” Sethi says on his website.

Monarch Money’s expense tracking system makes managing your monthly budget easier. The platform seamlessly connects all your accounts in one place, giving you a clear view of where you’re overspending.

By linking your credit card accounts, for example, you can monitor your payment progress in real-time and set specific goals to get out of credit card debt faster.

For a limited time, you can get 50% off your first year with the code NEWYEAR2025.

Read more: I’m 49 years old and have nothing saved for retirement — what should I do? Don’t panic. Here are 5 of the easiest ways you can catch up (and fast)

Automatic saving

For high-income earners, it’s important to set money aside for savings and investments first, before splurging. Credit reporting giant Experian calls this method “reverse budgeting” and says this method restricts discretionary spending, because you can only spend what’s left after meeting savings targets, and bolsters financial resilience.

You don’t always have to put away large sums to move toward your savings goals. Ten dollars a week could make a difference – if you’re smart about what to do with your spare change.

Acorns rounds up the price to the nearest dollar and invests the difference for you in a smart investment portfolio.

For example, if you buy coffee for $4.30, Acorns will round up to $5.00 and automatically save that 70 cents. These small amounts can add up significantly – just $2.50 in daily round-ups could accumulate to $900 per year, helping you build your savings without thinking about it.

Plus, if you sign up now you get a $20 bonus.

Cut costs where you can

Take a hard look at your monthly expenses. For instance, many people are overpaying for car insurance simply because they don’t compare rates regularly.

OfficialCarInsurance.com makes it easy to compare quotes from leading insurers in your area, potentially saving you hundreds of dollars annually on premiums.

The process is 100% free and won’t affect your credit score. In just a few clicks, you could pay as little as $29 a month.

The money you save on lower insurance rates can go directly into your emergency fund or savings accounts.

News

Fired and Furious: Joy Behar and Whoopi Goldberg’s Secret Meltdown Rocks The View!

Joy Behar Opens Up About Rumors She And Whoopi Goldberg Are Getting Fired From The View: ‘Sorry To Report To…

Whoopi Goldberg Has Scathing Message For Men Who Believe ‘Your Body, My Choice’

Whoopi Goldberg Has Scathing Message For Men Who Believe ‘Your Body, My Choice’ “The View” host took aim at “anonymous”…

Jennifer Lopez Flaunts Her Incredible Curves In Leggings.

Jennifer Lopez Flaunts Her Incredible Curves In Leggings. Jennifer Lopez has once again set social media on fire, stepping out…

Whoopi Goldberg ripped for wild views on transgender women competing in female sports.

Whoopi Goldberg ripped for wild views on transgender women competing in female sports. Whoopi Goldberg is facing backlash online for…

The View Goes Insane: Whoopi’s [email protected].!.ff Dance Party Sparks Outrage and Madness!

Watch Whoopi Goldberg lead The View cohosts singing, dancing about harmful tariffs to the tune of ‘The Hokey Pokey’ “You put the…

Whoopi Goldberg Thr.3.at.3.ns to Smash Teeth of Men Who Dare Control Women’s Bodies!

“The View”’s Whoopi Goldberg warns that men who say ‘your body, my choice’ to women won’t walk away ‘with teeth…

End of content

No more pages to load